When it comes to getting paid, businesses have lots of options! Credit cards, mobile wallets, peer-to-peer payments, you name it. But it's not just about having choices, business owners need to consider what's most cost-effective and customer-friendly. That's why we love ACH (Automated Clearing House) transactions. It stands out as essential for customer transactions, payroll, and more.

What is the Automated Clearing House (ACH)?

You might not know it, but you may have used ACH payments in the past. The ACH is an electronic system for transferring funds directly between banks and credit unions in the United States. It processes billions of transactions each year, silently powering things like:

- Direct deposit payroll

- Recurring bill payments (subscriptions)

- Large business-to-supplier transactions

- Tax payments

Key Takeaways

- ACH payments are a cost-effective and secure alternative to traditional checks and credit cards. They are ideal for recurring payments and offer faster processing times than checks.

- There are two main types of ACH transfers: debits (you pay someone) and credits (someone pays you). Both are generally completed within 1-3 business days.

- Businesses can benefit from accepting ACH payments by reducing processing costs, improving customer convenience, and offering a wider range of payment options.

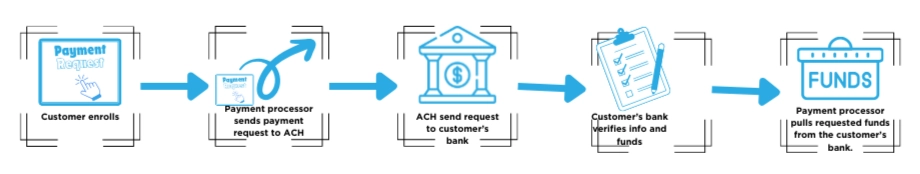

How Does an ACH Transfer Work?

ACH transfers work by moving funds from one bank account to another through the ACH network. There are two main types of ACH transfers:

- ACH Debit: This is when you authorize a business to take money directly from your checking or savings account, often used for bill payments or recurring charges.

- ACH Credit: This is when money is electronically deposited into your account, such as with direct deposit for payroll or government benefits.

Here's a breakdown:

1. Initiating the Transfer: The transfer is initiated by either the sender (you) or the receiver (the business you are paying).

2. Network Involvement: The sender's bank submits the transfer request to the ACH network.

3. Batching and Settlement: The ACH network batches transfers throughout the day and settles them four times daily.

4. Funds Movement: The receiver's bank receives the transfer notification and deposits the funds into the recipient's account.

ACH vs. Other Payment Methods

Benefits of ACH Payments

- Cost-effective: Lower transaction fees compared to credit cards and wire transfers.

- Convenient: Ideal for recurring payments and eliminates the need for checks.

- Secure: Reduces the risk of lost or stolen checks and credit card fraud.

- Faster than checks: Funds transfer electronically in 1-3 business days.

ACH payments are a secure, convenient, and cost-efficient way to transfer funds electronically. Businesses can benefit by offering ACH as a payment option, enhancing customer convenience and potentially reducing processing costs.

Ready to Get Started Accepting ACH Payments?

Our expert team can help:

- Evaluate your business needs. Is ACH the right payment strategy for your business?

- Choose as your payment provider. At EPAYENT we offer a one-stop solution for various payment methods, including ACH, with transparent pricing. We have solutions that integrates with your existing system(s).

- Set up ACH processing. We can guide you through the setup and integration process, allowing you to focus on what you do best: running your business.

We are here to help

- Schedule a Call: Book an Appointment

- Send us an Email: support@epayment.one

- Speak to a Specialist: 801-931-0111

Sources

- National Automated Clearing House Association (NACHA) https://www.nacha.org/

- Federal Reserve Payments Study https://www.federalreserve.gov/paymentsystems/fr-payments-study.htm

- The Electronic Payments Association https://www.epa.gov/financial/makepayment